French startups raised a total of €542 million in 2012, up 93% from 2011, according to a report by JDN’s Hugo Sedouramane. The report, while annoyingly split into 9 different pages (stupid ad business) touches on some great points about this year in France, such as the influence of a few large rounds of funding on the overall amount: specifically, Deezer(€100M), Criteo(€30M), Spartoo(€25M), Viadeo(€24M), Fotolia(€117M) and Sensee(€17M)’s impressively large rounds of funding, making up more than half of the total amount of funding raised this past year.

French startups raised a total of €542 million in 2012, up 93% from 2011, according to a report by JDN’s Hugo Sedouramane. The report, while annoyingly split into 9 different pages (stupid ad business) touches on some great points about this year in France, such as the influence of a few large rounds of funding on the overall amount: specifically, Deezer(€100M), Criteo(€30M), Spartoo(€25M), Viadeo(€24M), Fotolia(€117M) and Sensee(€17M)’s impressively large rounds of funding, making up more than half of the total amount of funding raised this past year.

I love the smell of eCommerce in May

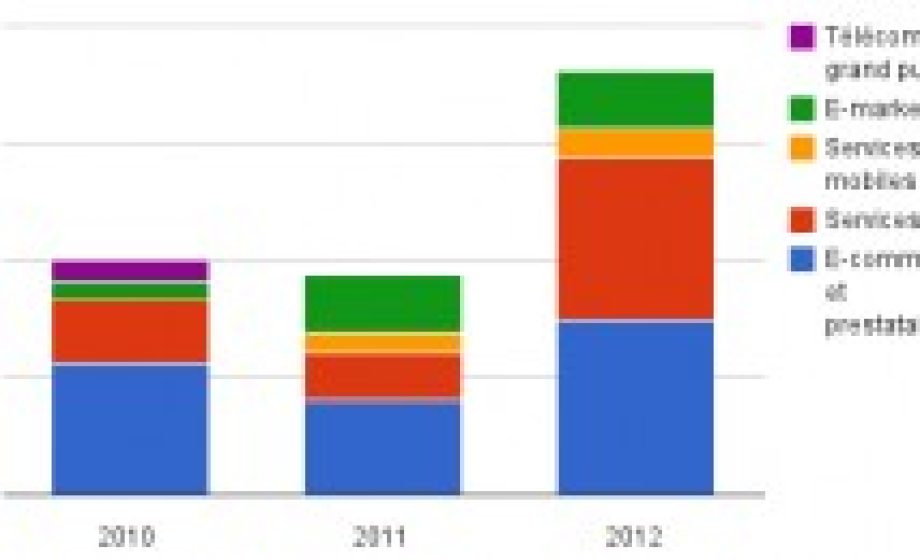

The report also goes on to breakdown funding by sector, showing that e-Marketing and eCommerce represented more than 50% of funds raised – a crippling number compared to the 6.8% of money which went to mobile. One of my most favorite images, featured to the right, was the breakdown in investments by date and amounts invested. Two distinct peaks reveal themselves, which top off in May & October – with the worst dips occurring in August (of course), and December.

The report also goes on to breakdown funding by sector, showing that e-Marketing and eCommerce represented more than 50% of funds raised – a crippling number compared to the 6.8% of money which went to mobile. One of my most favorite images, featured to the right, was the breakdown in investments by date and amounts invested. Two distinct peaks reveal themselves, which top off in May & October – with the worst dips occurring in August (of course), and December.

Investment is growing – International Investors getting curious

As we mentioned, a 93% growth in investment for France looks good, especially when we see that it is international investors making up some of the difference. The report notes that between Fotolia, Criteo, and Deezer alone, international investors put in nearly 250 million euros. In addition, foreign funds like Index & Accel have been up-ing their game this past year – despite Business Objects founder Bernard Liautaud making regular trips to Paris in the form of open office hours, France saw little to no investment from Balderton Capital, the fund where he is a partner.

What does 2013 hold?

Hopefully France will continue to see more foreign investment. I know this may make many VCs unhappy, as it will push up valuations on startups in earlier & earlier stages, but Rude Baguette will be working very hard in 2013 to create more cohesion between international investors and the French ecosystem. There is a great new generation of startups that I’ve seen brewing these past few months, and I’m looking forward to watching them continue to grow in an ever-growing ecosystem.