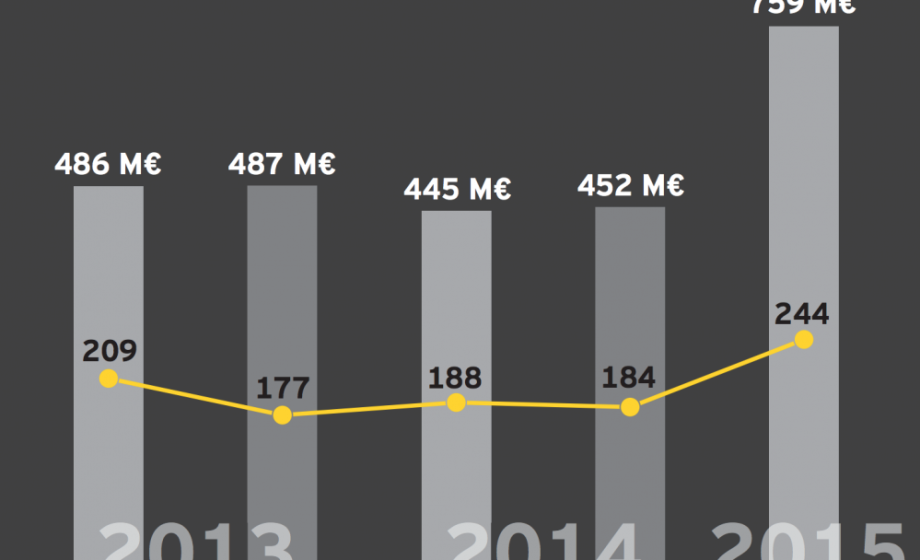

EY has released their bi-annual report on France’s private equity market, and the numbers look promising. After ISAI’s Business Angel report showed that, finally, business angel activity in France is starting to pick up, it looks like VCs can boast the same activity. €759 Million was raised in the first half of the year, putting France on track to raise €1.6 Billion in 2015, an increase of 70% compared to the same period last year.

Topping off that list were Sigfox, Devialet & Pret d’Union, although, contrary to Tech.eu’s analysis on fundraising in the UK & Germany, Sigfox’s €100 Million+ round from earlier this year (the largest single fundraising in France so far this year) contributed less than 15% to the total amount, suggesting that money isn’t just getting raised by small outliers, but by more startups across the board. The average fundraising amounts per round type were €500K, 1.7M€, 4.1M€ & 10.4M€ for Seed & Series A,B,C respectively.

While EY’s report backs up Tech.eu’s analysis that Germany has surpassed France in terms of total amounts raised, EY points out that France is still seeing a larger percentage of total fundraising amounts (up 30% over last year), reinforcing Germany’s outlier problem – eCommerce is growing in Germany, and very few players are taking the lion’s share of capital. What’s further, while I can’t back this up statistically yet, I would venture to say that eCommerce success stories contribute less to future successful startups down the road than technologically-driven success stories (this seems to also be true for the gaming industry).

Among the top ‘sectors’ invested in (“technology,” Internet, software & life sciences), the most interesting point was to see that €50 Million was raised by 10 FinTech startups in France like Slimpay, suggesting that France’s dormant FinTech sector may finally be waking up.

There’s no doubt that France has dipped in terms of fundraising; however, France still has an issue with great startups leaving to California – Docker & Algolia among them. Germany’s Rocket Internet has rekindled fire to the idea of companies listing in Frankfurt, and the line between London & Paris continues to get blurred.

One thing is a sure: on a European level, venture capital interest is growing, and there is plenty of supply to respond to the increase in demand.

Up 70% from 2014, 250 French startups pulled in €750 Million in H1 2015

Uncategorized