It’s true. French companies don’t have the same acquisition culture as some of the American tech darlings, like Google or Facebook. And it definitely doesn’t help the local exit market. French and other European companies often look across the Atlantic when it comes time to go public or get acquired.But just because there are more exit opportunities elsewhere doesn’t mean there are none at home.

It’s true. French companies don’t have the same acquisition culture as some of the American tech darlings, like Google or Facebook. And it definitely doesn’t help the local exit market. French and other European companies often look across the Atlantic when it comes time to go public or get acquired.But just because there are more exit opportunities elsewhere doesn’t mean there are none at home.

Why hello there, Ubisoft.

Recently, I’ve been a little pleasantly surprised by French gaming giant, Ubisoft. The company founded by Brittany-born Yves Guillemot (who is on my list of 9 French entrepreneurs to know and rightfully deserves to get an English-language Wikipedia page) caught my attention earlier this year when it acquired one of my all-time favorite French gaming startups: Owlient. The amount of the acquisition was never revealed (but many people guestimated a figure around €10 million for the company founded in 2005 by a couple of French university students). And just this week, just a few months after the Owlient acquisition, Ubisoft is gulping up Finnish developer, RedLynx. Ubisoft also made several other acquisitions in the last few years, including Quazal (Canada, 2010), Nadeo (France, 2009) and Massive Entertainment (Sweden, 2008).

Recently, I’ve been a little pleasantly surprised by French gaming giant, Ubisoft. The company founded by Brittany-born Yves Guillemot (who is on my list of 9 French entrepreneurs to know and rightfully deserves to get an English-language Wikipedia page) caught my attention earlier this year when it acquired one of my all-time favorite French gaming startups: Owlient. The amount of the acquisition was never revealed (but many people guestimated a figure around €10 million for the company founded in 2005 by a couple of French university students). And just this week, just a few months after the Owlient acquisition, Ubisoft is gulping up Finnish developer, RedLynx. Ubisoft also made several other acquisitions in the last few years, including Quazal (Canada, 2010), Nadeo (France, 2009) and Massive Entertainment (Sweden, 2008).

France Telecom: less suicide, more acquisition.

People love pointing fingers at some of France’s larger companies, like Orange/France Telecom or even Dassault Systèmes, saying that they don’t acquire enough. But even if they’re not fully owned by the company that has been struggling with employee suicides, both Deezer and DailyMotion have been partially acquired by Orange within the last 18 months. And Dassault Systèmes paid €135 million to acquire Exalead last year and another $36.5 million in spring for US-based Intercim.

Still, no Google gobbler.

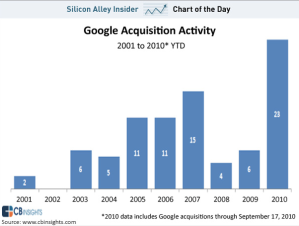

Ok, sure, the number of acquisitions rests incomparable to the dozens of companies that Google is gobbling up. But Google has made some acquisitions – like Aardvark, which is shut down in September – that haven’t really gone anywhere. Interestingly enough, French companies do not seem to be striving for talent acquisitions in the way that Google may’ve been trying to get at former Facebook employees with the $100+ million offer they made to acquire Path.

E-commerce and dating: giants or sell-outs?

It should hardly shock anyone anymore that France is just full of e-commerce and dating sites. After all, I’ve been blabbering about this for a while. French entrepreneurs often argue that investors only want to fund e-commerce companies because of the “proven” revenue model. And there was a period of time where I couldn’t open my inbox without having another press release from a new dating startup. But why is there no French e-commerce or dating giant? Vente-privée and Meetic, I’m looking at you. I don’t think there has been a single acquisition discussion concerning Vente-privée (other than its own acquisition discussions with Amazon). Meetic, on the other hand, did acquire quite a bit – including DatingDirect, Neu and Cleargay – but finally decided to cave in to American Match.com earlier this year.

Slower innovation is still innovation.

It’s likely that the overall trend of fewer acquisitions demonstrates a slower innovation curve in the long run. I would love to see more of the larger local companies offer acquisition opportunities to startups. But still, just because companies aren’t acquiring by the dozen doesn’t mean that France is void of exit opportunities altogether.