Late last night, Journal Du Net reported that Mention, the social media app that lets you track your brand, name or otherwise, has raised a 600,000€ round of funding from Alven Capital and Berlin-based Point Nine Capital. Mention’s founding team consists of Edouard de la Jonquière(CEO) & Arnaud Le Blanc(CTO),as well as the eFounders team, which notably includes former Fotolia CEO Thibaud Elzière. According to the announcement, Mention, whose competitors include Hootsuite and other 3rd party social media apps, currently has 50,000 users, and plans to use this first round of funding to launch in the US.

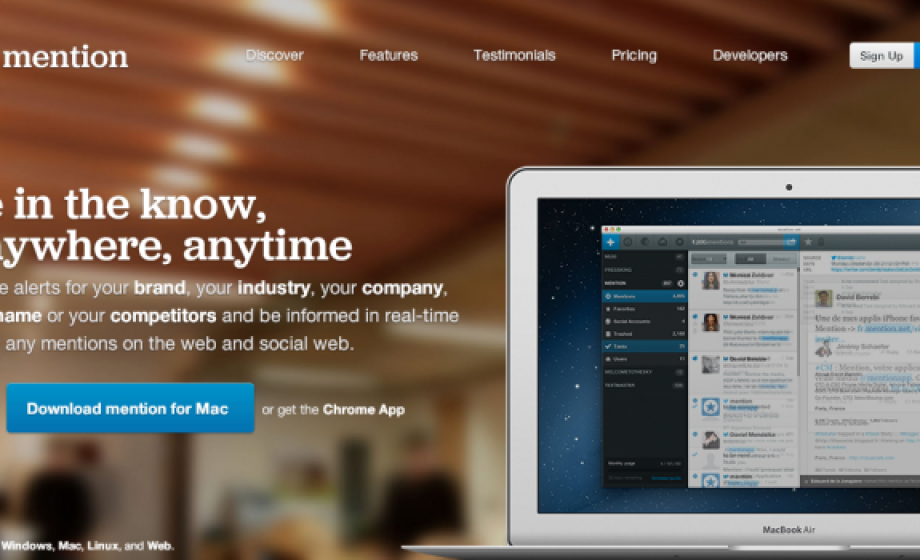

Available on iPhone, Android, Mention lets you track various keywords, receive alerts when keywords are mentioned on the web, and provides social media analytics – in short, it’s Google Analytics for Social. The app has a Free Plan, which allows you to receive up to 500 mentions per month with a one month history stored, and a Pro Plan with up to 50,000 mentioned per month for just 19,99$/month. They also offer a “Team Plan.” Mention hasn’t communicated much on what its conversion rate is for users from Free to Premium, but I imagine it falls in line with the rest of the freemium services, so we can imagine they’ve got around 500(~1%) premium users paying at least 20$ per month.

First investment for Alven Capital IV ! http://t.co/TSe1apq2Rl

— Alven (@alvencap) March 13, 2013

While the startup has not yet annoucned the fundraising officially on its blog of via press release, Alven Capital’s twitter account confirmed the fundraising, and also added that this is the first investment they are making with Alven Capital IV, their latest fund which they are in the process of securing. In addition, this is a great example of one of Germany’s newest and most active funds investing cross-border. Ciaran O’Leary recently posted to his personal blog, berlinvc.com, a post regarding EarlyBird’s latest fund (where he is a VC) and how borders are slowly disappearing in his fund. I hope to see more of this in the future, as French, Belgian, German or otherwise European startups, realize that you can raise money from whoever can add value (and cash) to your startup.

http://www.youtube.com/watch?v=-K9p8di_6Wo