All posts in RudeVC

Predictions are hard, especially about the future

The previous RudeVC column on predictions from smart European VCs generated a lot of feedback. Many readers apparently liked the diverse, pan-European nature of the perspectives. Some zoomed in on the granularity of them, agreeing with some and questioning others. One reader questioned the relevance of limiting the predictions to a one-year period. It’s a […]

Predictions on the State of VC in Europe 2015

Rather than merely spouting my own views on what’s in store for the VC sector in Europe this year, I decided to solicit the opinions of my more omniscient peers. Here are the thoughts from several top-tier European VCs: Marc Fournier, Serena Capital, France: 2015 should be another great year for technology and venture capital. […]

Dear LaFrenchTech: Let’s never stop learning

Arguably at one point the hottest tech conference on the European continent and still undisputably one of the top tier events, LeWeb took place last week and brought leading international entrepreneurs and investors like Phil Libin, Hiroshi Mikitani, Kevin Rose, Yossi Vardi, Tony Conrad, David Hornik, Jeff Clavier, and Fred Wilson to Paris. The conference […]

My five takeaways from LeWeb Conference

My five takeaways from LeWeb Conference 2014: The sharing economy is already impressive, and we ain’t seen nothing yet. Bitcoin has fallen out of favor, for now, and hence is probably a good contrarian play. Japan tech is the ultimate contrarian play. Expect the unexpected when a French politician takes the stage. Meditation is the […]

European entrepreneurs: Beware the Silicon Valley travel trap

There seems be a growing trend in startup communities throughout continental Europe that I find a bit fatiguing. It has to do with the plethora of consultants offering to organize tailored travel packages for young tech companies to global tech hubs, usually Silicon Valley. Consultants are like ants: they usually show up when there’s a […]

Musings on VC internships in France

Last Friday at the office we held the pôt de départ (farewell party) of one of our interns. Although this young man was not working directly with me, I know that my colleague greatly appreciated this intern’s contribution for six months. This was my colleague’s first experience of recruiting a VC intern in France, and […]

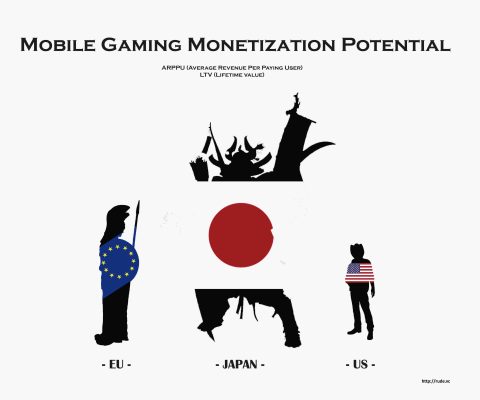

Is investing in gaming like betting on Hollywood?

On a recent trip to Tokyo, I met with a handful of business partners and investors in the mobile gaming sector, one of my investment themes over the past few years centering on European endeavors in this space. A familiar debate comes up every time: Is mobile gaming as a sector still investable? Has mobile […]

11/11: Remembering our veterans and remembering the genesis of the EU project

Today is a holiday: 11/11. Europe celebrates it as Armistice Day, commemorating the end of World War I (the war to end all wars), of which the fighting stopped on the eleventh hour of the eleventh day of the eleventh month of 1918). The Commonwealth nations observe 11/11 as Remembrance Day in honor of the […]

Here’s hoping the ISR trend does not become Corporate Greenwashing 2.0

Socially responsible investment practices, or ISR in French (investissement socialement responsable), has been catching on among fund management companies in France lately. The notion of SRI in modern portfolio management began gaining momentum in the late 1990s, mainly in the US and UK. The first sell-side brokerage in the world to offer SRI research was […]

What I think about when I think about mobile gaming

When people inquire about my investment strategy, I explain that I try to structure my investment thinking around themes or theses. Readers of this blog will recognize that one of my favorite investment themes over the past few years has centered on the value chain of mobile gaming. Often, I visualize aspects of a theme […]