The global financial platform Revolut has raised an additional $500 million in a Series D funding round, bringing the total round to $836 million, according to TechCrunch.

It also boosts Revolut’s total value up to $5.5 billion, making it one of the highest valued fintech startups in the world, with over 10 million customers.

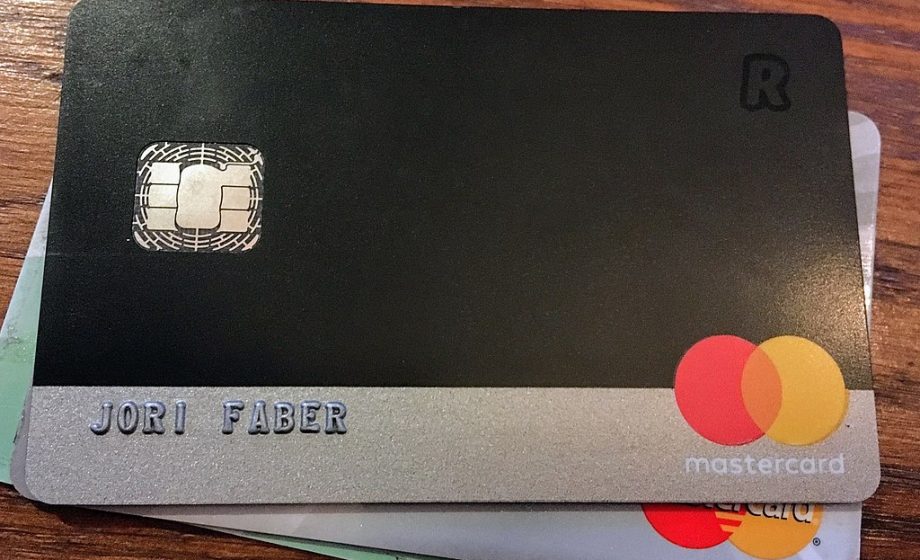

The platform offers financial services that aim to replace traditional bank accounts. An account can be opened through Revolut’s app in mere minutes, and money spent directly from the app or through a debit card.

It offers additional features that appeal to tech-savvy users, like a built-in cryptocurrency exchange, international currency exchange, a debit card that allows withdrawals in 120 countries, and insurance for phones.

Its total number of users grew 169 percent in 2019, and revenue grew 354 percent the year before that.

Most of Revolut’s users are in the UK and Europe, though a beta version has gone live in Australia. In the coming months, launching in Japan and the US will be a major focus.

The Series D funding round was led by the US growth capital firm TCV, with participation from existing investors.

The funding will be used primarily to enhance customer experience and to drive product development to increase the number of daily users in Europe. The firm plans to expand its two subscription tiers, Premium and Metal, which offer bonuses like unlimited currency exchange, airport lounge access, and travel insurance.

The company already employs 2,000 people, and plans to use the new funding to expand its workforce.

Revolut is also aiming to become profitable in 2020.

“We’re on a mission to build a global financial platform – a single app where our customers can manage all of their daily finances, and this investment demonstrates investor confidence in our business model,” said CEO and founder Nik Storonsky.

“Going forward, our focus is on rolling-out banking operations in Europe, increasing the number of people who use Revolut as their daily account, and striving towards profitability. TCV has a long history of backing founders who are changing their industries on a global scale, so we are excited to partner with them as we prepare for the next stage of our journey.”

Since it was founded in 2017, Revolut has already become one of the world’s highest-valued fintech companies.

Photo by JFD~nlwiki / CC BY-SA (https://creativecommons.org/licenses/by-sa/4.0)