France allegedly crowned its first unicorn last week when BlaBlaCar raised a new funding round led by Insight Venture Partners of $160 million at a post-money valuation of $1.2 billion.

Actually, there is some debate on whether BlaBlaCar represents France’s very first unicorn (some argue that Vente-Privée should hold that title, but that’s beside the point). So far, there are at most three French tech startups that have surpassed the 1B$ valuation threshold (BlaBlaCar and Vente-Privee, plus Criteo in the public markets). The largest herds of European unicorns currently reside in the UK and the Nordics.

Bravo à @BlaBlaCar_FR nouvelle #licorne française, avec une nouvelle levée de fonds à 160 M$ qui porte sa valeur à 1,2 mds$

— Axelle Lemaire (@axellelemaire) September 8, 2015

The term unicorn is annoyingly overused and increasingly inaccurate. However, investment bankers, research analysts, and investors love it (not to forget tech journalists, of course). Government officials across the continent have also almost universally adopted the unicorn mantra. Some use it as a metric on which to score petty rivalries about whose nation’s capital boasts the best tech ecosystem. French initiatives like LaFrenchTech and organizations like La Banque Publique d’Investissement claim to be unicorn catalysts. (On a side note, I find it ironic how many local VCs claim to be hunting unicorns. Investors like Index and Accel can make this claim with some legitimacy. For the other supposed unicorn-hunters: you’re not executing on your stated strategy very well).

Nonetheless, I believe that France, like many European countries, will witness more tech unicorns in the near future. These are exciting times for the various continental tech ecosystems. The new generation of European entrepreneurs set their sights on global expansion from the beginning, a necessary ambition for those who aspire to reach the unicorn club. I am optimistic.

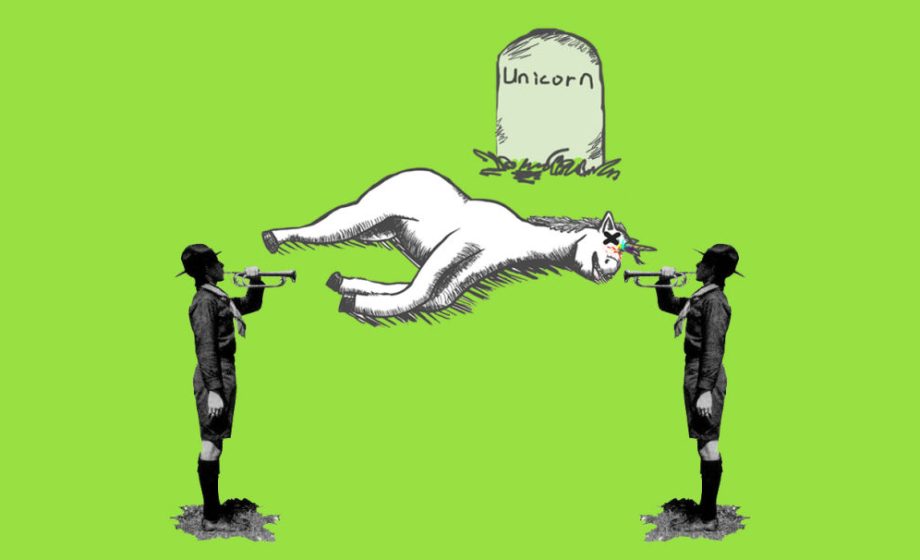

Although there is little doubt in my mind that France will produce more tech unicorns in short order, I’m looking forward to a more macabre milestone: France’s first unicorpse.

Now please don’t misunderstand me. I applaud each and every one of these unicorn companies for what they have accomplished, and I wish them no harm. I also salute the as-of-yet unsung heroes: the entrepreneurs who are still struggling out of the spotlight to reach escape velocity. Some of you will eventually join the unicorn club, whereas others of you may not cross the $1B barrier but still build great companies of lasting value. Just like I wept at the end of Seabiscuit, I do not take pleasure in seeing a bunch of dead unicorn carcasses.

However, although Aileen Lee’s term unicorn refers to an arbitrary valuation threshold (remember: $1B is just another number), there is something stratospheric, ostentatious, and memorable about the $1 billion mark. On today’s scales, when you’ve crossed $1B, you’ve made it beyond the big leagues; you’ve become a near-mythical creature.

By the same token, a $1B failure will also be monumental. The topic of faltering unicorns is currently taboo, and any supposed “dying unicorn lists” are maintained in secret. But make no mistake, there will be blood. Probably several unicorpses. Such is the nature of venture building. This is actually a good thing, because global success stories of game-changing disruption cannot exist in an environment devoid of the occasional colossal failure.

France’s first unicorpse, whenever it happens, will represent a new inflection point. How the community reacts will reveal how sustainable our tech ecosystem really has become.