Wow, the appetite for FinTech in Europe is booming, with VC funding reaching dizzying heights.

It’s not just Europe, by the way. A recent visit to Bangkok confirmed that even in the emerging startup ecosystem of Thailand, FinTech is hotter than a spicy som tam salad (more on that later).

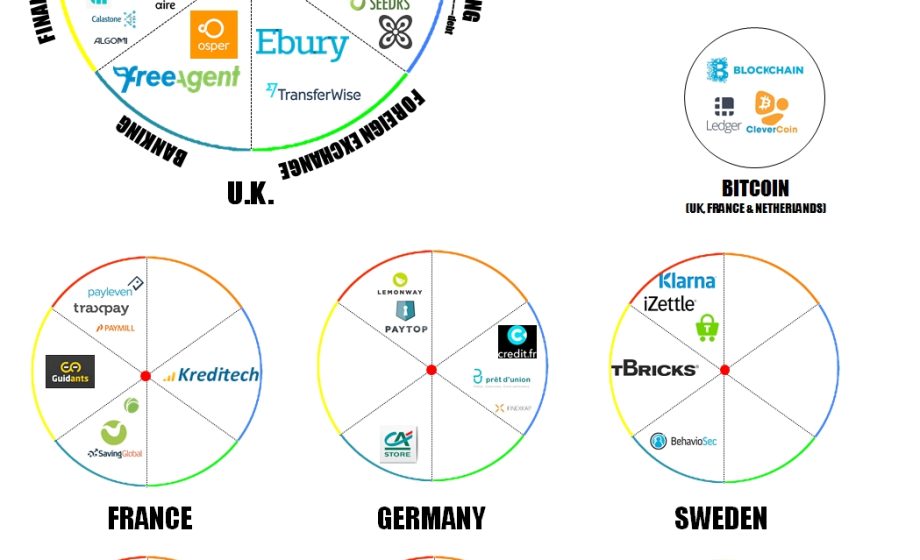

With the entire sector representing a market in the hundreds of billions of euros, it’s not hard to grasp the investment appeal. In order to bring a bit of method to the madness, here’s an infographic I produced based on research handily performed by my trusty intern (props to J.Peng!). Let’s call this the RUDEscape of FinTech companies in Europe.

[By way of full disclosure, Truffle Capital is an active investor in the FinTech space; however, I am not personally involved and hence cannot claim any credit. The brain behind Truffle’s FinTech portfolio is Cofounder and Managing Director Bernard-Louis Roques, who has financed or incubated four such investments in the space to date: Paytop, Smile&Pay, Credit.fr, and Wizypay. Here’s an interview in which Bernard-Louis lays out his vision for FinTech.]

And now introducing the European FinTech RUDEscape: