Partech International, a VC fund with roots in France, Germany & the Silicon Valley, has closed its seventh fund with €160 Million, Les Echos[fr] reported this week. €30 Million of that fund will go to “Partech Entrepreneur” an early stage fund that will break the mold of most of Partech’s investments, which usually sit in the Series B range and have never gone below €2 Million. The seed investments are expected to reach anywhere from €200K-500K, with Partech’s Philippe Collombel noting that the investments will mostly be in the team.

Partech International, a VC fund with roots in France, Germany & the Silicon Valley, has closed its seventh fund with €160 Million, Les Echos[fr] reported this week. €30 Million of that fund will go to “Partech Entrepreneur” an early stage fund that will break the mold of most of Partech’s investments, which usually sit in the Series B range and have never gone below €2 Million. The seed investments are expected to reach anywhere from €200K-500K, with Partech’s Philippe Collombel noting that the investments will mostly be in the team.

Partech’s most recent €100 Million fund was raised in just 2011; however, a large majority of that fund has already been invested in companies like Total Immersion, Qapa, Sensee, Sigfox & most recently Scoop.it. Partech is just the latest in a series of French funds to raise a new fund, underscoring the healthy venture ecosystem that France has built up for itself:

%CODERUDEINFOVC%

Nearly every VC fund in France has closed a new round in the past 13 months; the exception perhaps being Xange, though their recent exit with Neolane to Adobe for $600M should take care of any fundraising issues.

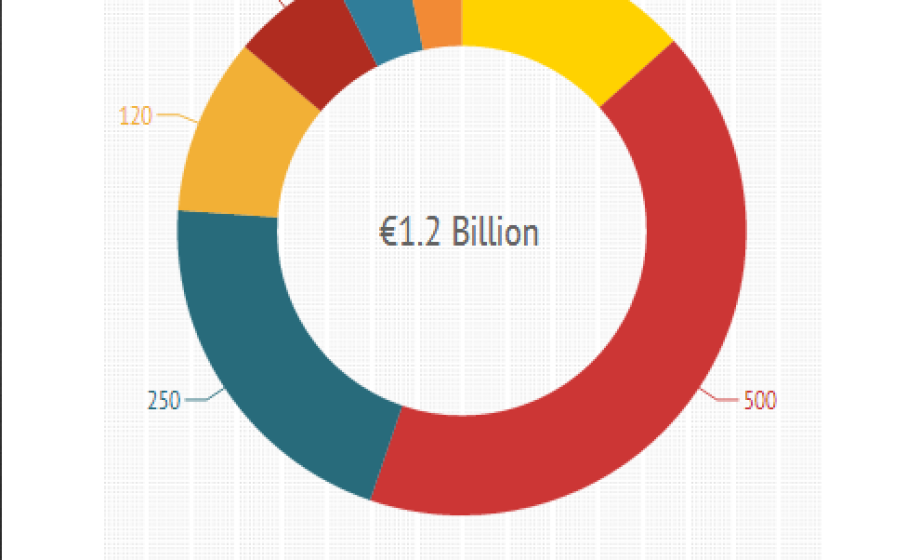

By my count, there is now well over €1 Billion under management by active French VCs investing in French startups. That’s not counting Balderton Capital, Index Ventures, Point Nine Capital, and the scores of other VCs trying to get deal-flow in France.

SEE: Alven Capital close to closing their 120 million euro fourth fund

SEE: ISAI raised €50 Million Expansion fund

SEE: Elaia Partners closes €40 Million Alpha Fund

SEE: Ventech breathes new air with new €75 Million fund

SEE: 360° Capital Partners closes long awaited new fund

SEE: IDInvest closes Second Senior Debt fund; exceeds 250M€ (PeHub)

SEE: On the back of a successful first fund, Serena Capital announces a second €100 Million fund