When I joined my partners at the Hardware Club to re-focus myself on investments in hardware startups, my former boss at my previous VC firm warned me, out of concerns about my career, that hardware startups were capital inefficient and would not be able to generate the investment returns as well as lean startups.

At the time, I did not try to refute him, party due to that there were not enough data back then. Since then various hardware startups such as Nest, GoPro, Oculus VR and now Fitbit made their way to great exits either through IPO or M&A, making generous returns for their investors. In addition, various young hardware startups have nudged their way into the realm of unicorns, led by the ridiculously fast rising Xiaomi. I feel that it’s time to do an official analysis and refute this popular myth of capital inefficiency in hardware startups compared to their lean brothers.

Let me jump to the conclusion first: successful hardware startups are as capital efficient, if not more, as their lean counter parts. They will generate as good, if not better, returns for their VC investors.

First let’s define what is capital efficiency.

In general, capital efficiency is a measure of how much value could be generated from a certain amount of investment over time.

The best measurement for capital efficiency would be IRR (Internal Rate of Return), which calculates the effective annualized return rates over multiple rounds of cash investments and the cash returns. However, IRR could be cumbersome to calculate over a large amount of samples and data could also be difficult to get.

In the case of late-stage startups, we could use a quick-and-dirty multiple to assess their capital efficiency:

This multiple is somewhat similar to to market-to-book ratio of a public company, in which the market capitalization is divided by the book value of the equity, which is no more than a net sum of all the equity capital inflows/outflows as well as the retained earnings throughout the firm history.

In the case of startups, most of them won’t make money until sometimes even several years after going public or being acquired, so accumulated retained earnings usually don’t exist on their balance sheets. Also, equity capital outflows in the form of share buybacks are rare. In other words, the total amount of VC investments is almost always the most dominant component in the equity row on the balance sheets.

Another nuance is that total VC investments in a startup are in cash, unlike the book value of a public company, which might not correspond 100% to the actual net cash flowing into and retained in the company over the years. In this sense, the Capital Efficiency Multiple as defined above is more meaningful than a market-to-book value.

It’s clear that the larger the capital efficiency multiple, the better. A larger multiple means that the startup was able to use the same amount of VC money – usually the dominant form of financial cash flows for a startup – to create a higher net present value of the firm – assuming no debts taken – for the shareholders, which include the founders, employees and all other equity investors.

With this simple calculation, we could now map out the capital efficiency of the 100+ unicorns currently existing in the venture world.

For my analysis, I use the data gleaned from the unicorn list maintained by TechCrunch. As a side note, TechCrunch’s representation of unicorn data is inherently better than competitors such as Fortune Magazine. And since the system is apparently linked to its database, we should be able to see an up-to-date unicorn snapshot anytime we check the page as long as CrunchBase data are kept current.

At the moment of my analysis, the page counts 143 unicorns around the world, led by the now household names such as Uber, Xiaomi and Airbnb. Obviously the venture startup world typically winner-takes-all, so the most successful 20 among them grab more valuation than the other 123 combined.

But valuation is just one part of the picture. You could have a high valuation but if it has taken a lot of capital to get there, it’s not really capital efficient and therefore not a good investment.

The calculation of capital efficiency multiples, based on the aforementioned definition, would be simply taking the column “Post Money Valuation” and divide it by the column “Total Equity Funding”.

We, therefore, arrive at 143 multiples, ranging from a poor 1.6x to a ridiculous 97.8x.

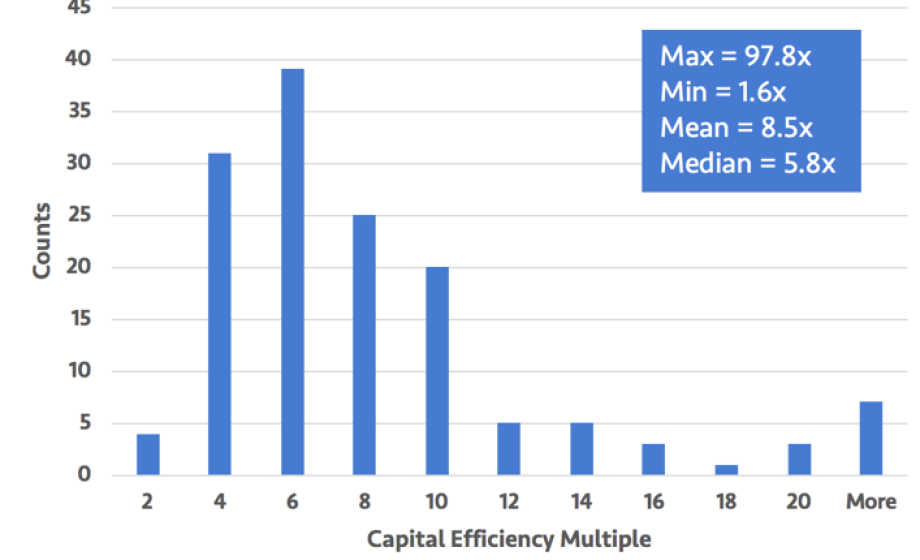

Here’s the distribution of the multiples:

As one can see, the highest count is a multiple of around a multiple of 6.0x, meaning that these startups needed $166M of VC cash over the years to reach the status of a unicorn, i.e. with $1B valuation of its equity. This is not too bad but depends on the dilution, some investors might not be making its required rate of returns.

On the other hand, there are 3 startups that have a multiple of 20.0x, which means that they needed less than $50M to achieve the unicorn status. These three startups are Lufax, China Rapid Finance and Razer – the first two are financial service startups in China while Razer is an American hardware startup based in San Diego.

Yeh, you see that right. That is a hardware startup achieving a 20X capital efficiency, without the “Chinese effect”. And if a 20X startup qualifies as a home run, then this is not just a decent batting average of 0.333 in the Major League, but rather an HOMERUN RATE of 0.333 for the hardware batters!

Further, if one notes that Uber’s multiple is a (good) 7.7x, Razer’s capital efficiency is nothing short of amazing!

Things get even more interesting if we count the ridiculously efficient “20x and more” members:

Leading the pack is the incredibly secretive Theranos led by the legendary Elizabeth Holmes. Having developed a disruptive technology that could detect hundreds of conditions and diseases from just a couple of drops of blood from the finger, the firm’s latest valuation is $9B. That makes Holmes, who still holds roughly 50% of the firm, a $4.5B-worthy billionaire. And the capital efficiency multiple is a jaw-dropping 97.8X!

The next two in line are both Chinese hardware startups. Lei Jun and his skyrocketing Xiaomi boasts a capital efficiency multiple of 40.9x, while the king of commercial drones DJI, recently valued at $8B, has an even higher multiple at 76.2x.

The four other “20x and more” club members include two Chinese lean startups that westerners are not familiar with, as well as the Luxembourg-registered Global Fashion Group that aims at emerging markets, and finally the popular payment services Stripe from the United States.

My dear smart readers, you might have noticed by now that among these Fabulous 7, only Stripe qualifies as the American lean startup that we’re most familiar with. Most others achieve ridiculous results via the Chinese effects and/or simply disruptive technologies.

And 2 out of 7 are hardware unicorns.

Let’s compare the distributions of the 42 software unicorns (by TechCrunch categorization) and the 7 hardware unicorns then.

Bear in mind that the sample size of hardware unicorns is still small compared to their software buddies, but at least they don’t look that different in terms of capital efficiency.

At this point, we could pretty much draw the conclusion: capital inefficiency in hardware startups is a myth, period.

The question is then: why aren’t software or lean startups more efficient than hardware startups as most people imagined?

I think in the grand craze of lean startup entrepreneurship, people tend to forget about some fundamental laws of economics and finance. Most notably, if something is relatively easy to get off the ground, it would also face more competition and would require more capital to stay ahead of others.

For example, in the realm of lean startups in Silicon Valley, we’re seeing higher and higher Series A amounts. Part of the reason is simply the increasing amount of VC dry powder sitting in the valley looking for targets. However, it’s also because more and more lean startups jump into similar offerings as soon as there’s some initial proof of product-market-fit. They therefore have to spend more money fighting for the same users. The Customer Acquisition Cost (CAC) keeps rising, reducing the Customer Lifetime Value (CLV) and therefore the value of the business. This is a direct impact on the capital efficiency.

The fact that many of them operate on the Freemium or SaaS models makes things even worse. It’s true that these two business models are easier to attract initial users and get off the ground, because the initial usage is free for the users. However, due to the inherent mismatch in receivable terms and payable terms, these business models need much more working capital the faster they grow.

And if the conversion rates are low, unstable or sensitive to economic cycles, the 20-year NPV derived from these models will also be calculated with higher discount rates, leading to a lower valuation (relative to the potential revenue in the future) and therefore a lower capital efficiency.

On the other hand, most of the modern hardware startups are fundamentally a product sales business. Even though they benefit from the lean-inspired focus on software user experiences, potential extra revenues in subscription services and big data, they still sell hardware products. In other words, they have the traditional receivable/payable terms that are linked to traditional inventory management. The working capital is therefore more visible. And excluding the 0% margin Xiaomi model that only works in China, most successful hardware startups enjoy very good gross margins today. If they could be efficient in other expenses, they could achieve positive operating cash flows earlier than Freemium or SaaS startups. This means that they could fund themselves through the growth stage without external capital injection, thereby leading to a higher capital efficiency.

And this is not just pure theorization. A good example would be the ridiculously successful Fitbit. Below is a table comparing it against Box, the star Cloud/SaaS unicorn that went IPO earlier this year.

Notice that it takes Box a whopping $559M to reach a $2.8B market cap at IPO, while it only took Fitbit a mere $66M to reach $6B market cap. That’s a sharp contrast in multiples of 5.0x versus 90.9x!!

More importantly, notice that Fitbit did not raise any VC money between its last round of $43M in August 2013 and its IPO in June 2015 – that’s almost entirely two years without outside funding, while it grew its revenue sub-$100M in 2012 to $745M in 2014! This is of course due to the fact that its hardware business started to generate positive operating cash flows earlier so that it could self-fund its own growth.

This also brings us to another nuance in analyzing the TechCrunch unicorn data — any hardware startup that did not need capital for quite a while would be stuck with a stale multiple that’s probably 1 year or 2 years old, simply because there was no new round of fundraising, compared to the frequent and necessary rounds of lean startups. This means that as we observe the old data, those hardware startups might have already achieved an even higher value. We could only discover that on their IPO days or their happy M&A exits to Google, Facebook or Apple.

One such example in our current list of hardware unicorns is NJOY, an e-cigarette startup based out of Scottsdale, Arizona. Their last round was almost 1.5 years ago, with $70M raised from Brookside Capital and Morgan Stanley on February 28, 2014. Given that the two investors are hedge fund and investment bank respectively, it’s mostly certain that this round is pure growth capital and the valuation of $1.07B was most likely very rigorously based on future cash flows. We have every reason to believe that the firm is probably already worth a lot more since this last round. We could only find out when it hits NYSE or Nasdaq someday.

And Fitbit is hardly an exception. Its arch rival – and our good friend at the Hardware Club – Misfit enjoys similar traction. Although we do not have detailed numbers, but Founder/CEO Sonny Vu mentioned in this interview with Forbes late last year that their $40M Series C was not for the money but for bringing in Chinese investors such as Xiaomi to allow them to better attack the Chinese market, where they already enjoyed a nice volume without knowing why. It’s easy to infer that Misfit is probably also operational cash flow positive and won’t really require external capital to sustain its growth for a while.

That is not to say the hardware startups definitely could achieve this. Far from it. Like any type of startups, if the hardware entrepreneurs could not execute well, it would still lead to the demise of the endeavor. Case in point would be the rumored trouble in the famous Pebble.

Still, with inherently positive gross margins — again, excluding Xiaomi model — and traditional working capital scenarios, good hardware startups should be just as capital efficient as their lean counterparts. If they’re not, it’s not because they’re doing hardware, but simply because they’re not the right people to do the startups.

And as a venture capitalist, I’ll put my money where my mouth is for sure. And why shouldn’t I, if I could find the next Nest, Oculus VR, Fitbit, Xiaomi or DJI?

=====