A conversation with a particularly insightful investment banker (yes, such a breed does exist) inspired me to do a little research over the weekend. His observation was that 2013 reminded him a lot about 1998 in the tech sector.

A conversation with a particularly insightful investment banker (yes, such a breed does exist) inspired me to do a little research over the weekend. His observation was that 2013 reminded him a lot about 1998 in the tech sector.

In 1998 I was an entrepreneur so consumed with my second startup that I rarely came up for air to pay attention to the macro events occurring around me. An investment banker, however, would have been able to see the forest from the trees.

Here’s why 2013 eerily exhibits many of the same traits that characterized the tech sector in 1998:

1998 bore witness to a wave of consecutively record-breaking venture financings. The tech news headline-grabbers of the day included: Ask.com, Cooking.com, E Ink, GeoCities, The Knot, and Priceline.

Within the past 12 months, albeit at an order of magnitude higher, Answers, Box, Deem, Dropbox, Jawbone, LendingClub, Spotify, Turn, to name a few all raised VC rounds in the range of 100’s of millions of dollars.

When a tech startup raises a big financing round, pressure mounts to deploy that capital on high-return projects, not just let the money sit in the bank. Some firms in 1998 squandered their funds on items like company cars and Aeron chairs, however even the most diligently-managed startups ran out of compelling ideas for organic development and started to look externally. Raising a large equity round mathematically translates into a large equity valuation. The need to justify such valuations can act as a catalyst for m&a.

Albeit not directly related, but as my investment banker friend reminded me, in 1998 the world witnessed an economic crisis in emerging markets. The Asian financial crisis took hold in Thailand, Hong Kong, Malaysia, Indonesia, Korea, and the Philippines. Shortly theafter, the Ruble crisis gripped Russia, and then in the third quarter of 1998 Argentina entered its economic depression. Similarly, in 2013 we’ve seen slowing growth and/or inflationary concerns fairly uniformly across the world’s BRIC countries. Conversely, developed countries fared well. The world’s economic engine, the U.S. economy, expanded at a decent clip of 3.2% in the fourth quarter of 2013. Aging Japan is demonstrating renewed vibrancy, and even in stale Europe, Germany, the Nordics, the UK, and even Spain are offering some glimmers of potential.

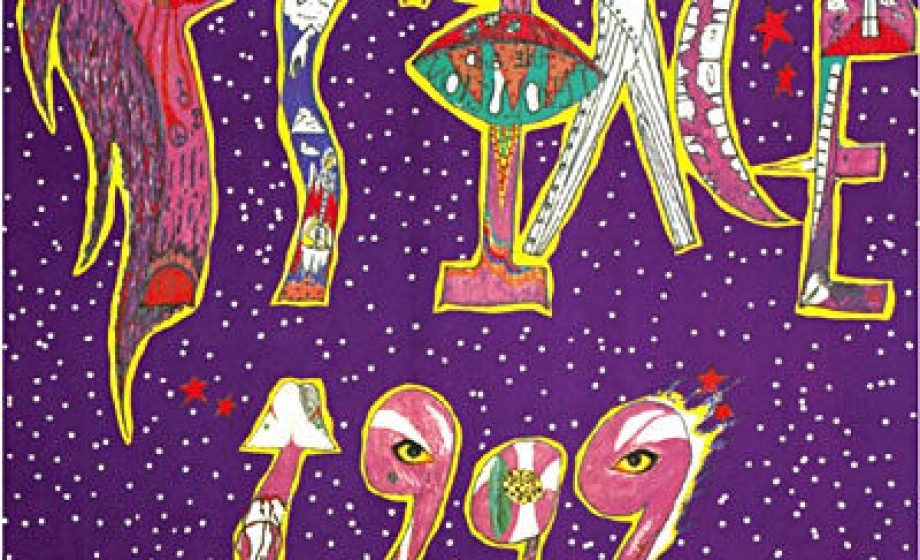

Cue Prince and the little red corvette

Here’s where it gets exciting. If 2013 in tech is like 1998, then maybe 2014 will turn out like… 1999, woohoo !

Well, let’s not get ahead of ourselves. However, there are some encouraging signs for those tech entrepreneurs and VCs who benefit from premium strategic acquisitions. In late 1998 and into 1999, a number of large public companies started facing questions from activist shareholders about their ‘Dot-com Strategy’. Nowadays, the interrogations center more on the strategies around mobile and big data.

Furthermore, the proportion of earnings misses rose. Feeling pressure from shifting market dynamics, demands for visionary leadership, and missed financial forecasts, managers of public companies can be tempted to view acquisitions as a convenient tool mask their shortfalls. The frenzy of tech m&a in 1999 was second only to an irrationally exuberant IPO market.

This time around, stock market investors appear to be more discerning, for the moment. But the pattern of surprises in earnings or business KPIs is unmistakable over recent weeks: LinkedIn, Amazon, Samsung, Apple, even freshly-public Twitter.

Geeks like me that were into futuristic tech thriller movies in 1998 probably watched Enemy of the State in the theaters. Will Smith played a genuinely likable lawyer whose life turns upside-down when he accidentally comes into possession of a video tape showing the murder of a congressman by NSA agents, assassinated to ease the passage of an overreaching surveillance bill.

Perhaps history doesn’t repeat itself, but it may rhyme.